Trump & Tariffs: India’s crude oil purchases from the US to surge in April-June

Crude from the US offers a viable option, providing high-quality, light-sweet grades that are well-suited for India’s refining capacities.

| Photo Credit:

RICHARD CARSON

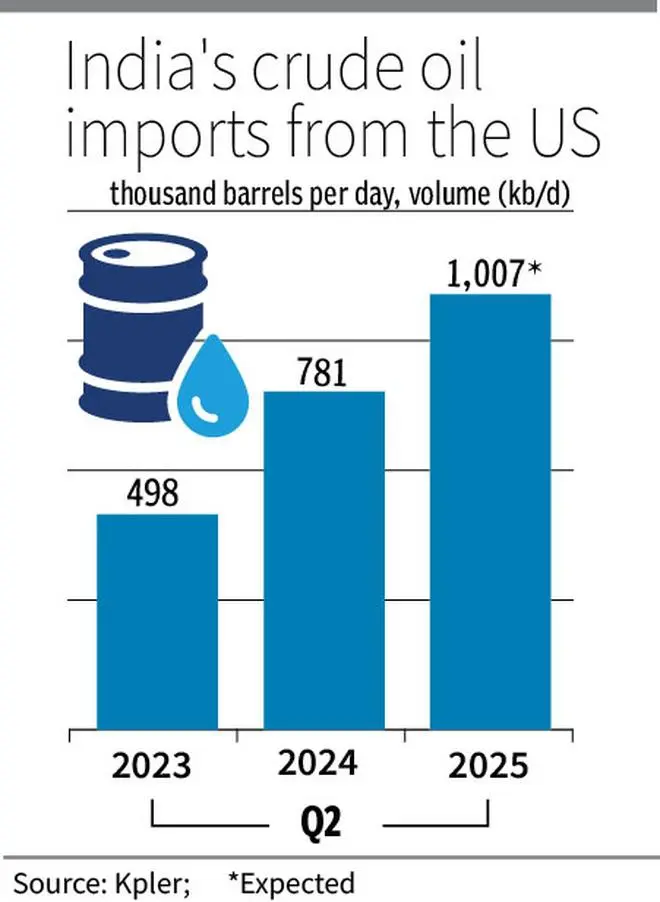

As India and the US deliberate on the fine print of a bilateral trade deal, the world’s third largest crude oil importer is expected to buy more than 1 million barrels per day (mb/d) from the US during April-June 2025—a record high.

This is in line with India’s stated position to enhance annual energy imports from the US to $25 billion from $15 billion currently. Both crude oil and liquefied natural gas (LNG) purchases from the US are already at a record high in 2024 calendar year (CY).

According to global real-time data and analytics provider Kpler, India’s crude oil imports from the US rose 17 per cent m-o-m and 68 per cent y-o-y to roughly 337 thousand barrels per day (kb/d) last month—an eight-month high—provisionally. April is the third consecutive month with in-bound shipments clocking higher volumes.

As per Kpler data, India is likely to import around 1,007 kb/d of crude oil from the US during April to June this CY, which is higher by 29 per cent y-o-y and more than double the imports during Q2 2023.

The US EIA data also points to a similar dynamic. India imported around 942 kb/d during April-June 2024, which is 43 per cent higher than Q2 2023 and 35 per cent higher than Q2 2022.

Imports during Q2 2024 are the highest on record, barring the Covid-impacted Q2 2021 when cargoes touched 1,355 kb/d as prices hit rock bottom.

Trade & Geopolitics

Sumit Ritolia, Kpler’s Lead Research Analyst for Refining & Modeling, told businessline: “US crude imports by Indian refiners—particularly public sector entities—are shaped by a mix of geopolitical considerations and trade diversification efforts. While diplomatic balancing may justify one or two cargoes, refinery economics ultimately drive sustained buying. Currently, discounted WTI prices are being used to stimulate Asian demand amid weakening Chinese appetite.”

US EIA in its December 2024 Short Term Energy Outlook, said that India emerged as the leading source of growth in global oil consumption in 2024 and 2025, overtaking China this year. This is important considering China’s oil consumption outpaced India’s almost every year from 1998 through 2023.

Ritolia explained that the exemption on crude oil and natural gas from tariffs, offers a strategic avenue to increase US energy imports without incurring additional tariff costs.

“Data indicates a significant uptick in US crude oil imports by India. In April 2025, imports reached around 337 kb/d. State-run refiners, including Indian Oil Corporation and Bharat Petroleum, have been at the forefront of this increase, accounting for over 70 per cent of the imports. This shift underscores a strategic pivot towards US energy sources, aligning with broader trade objectives,” he said.

Crude from the US offers a viable option, providing high-quality, light-sweet grades that are well-suited for India’s refining capacities.

“Additionally, increased US imports help mitigate over-reliance on Middle Eastern suppliers, enhancing energy security. Also, Nigeria and Angola may see their volumes to India fall as US supply gains ground. Strategic preference for light sweet grades amid reduced arbitrage from West Africa,” he added.

Cost Considerations

Despite higher freight costs associated with US crude, Indian refiners are evaluating the long-term economic benefits, said Ritolia

The compatibility of US light-sweet crude with Indian refineries, coupled with the strategic imperative to balance trade, justifies increased imports. Moreover, the potential for favourable pricing and stable supply further incentivises this shift, he added.

“If trade negotiations proceed favourably and tariffs ease or are strategically traded-off, we expect continued uptick in US-origin flows—particularly WTI Midland and Eagle Ford grades—as Indian refiners seek to balance price, quality, and political risk,” Ritolia projected.

Published on May 2, 2025

Post Comment