At ₹2,051 cr, IDBI Bank’s net profit is up 26% in Q4FY25

IDBI Bank received a huge write-back from non-performing asset (NPA) provisions to ₹2,759 crore

| Photo Credit:

REUTERS

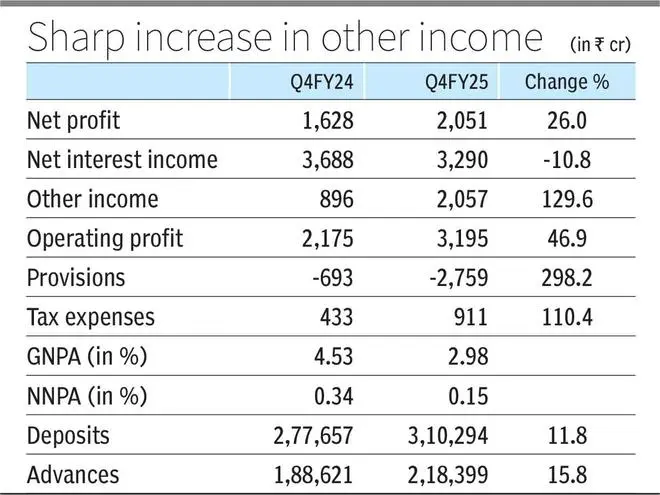

IDBI Bank has reported a 26 per cent year-on-year (yoy) increase in the standalone net profit of fourth quarter at ₹2,051 crore on the back of robust growth in other income and a sharp increase in write-back in loan loss provisions.

The private sector bank had recorded a net profit of ₹1,628 crore in the year-ago quarter. The bank’s Board of Directors, at their meeting on Monday, have recommended a dividend of ₹2.10 per equity share of face value of ₹10 each for FY25.

Net interest income (difference between interest earned and interest expended) declined about 11 per cent y-o-y to ₹3,290 crore (₹3,688 crore in the year-ago quarter).

Other income, including fee-based income, treasury income, profit/loss (including revaluation) from sale of investment, dividend received, recoveries from advances written-off, etc, soared 130 per cent y-o-y to ₹2,057 crore (₹896 crore). Recovery in written-off cases at ₹1,095 crore accounted for 53 per cent of other income.

Net interest margin declined to 4 per cent in the reporting quarter against 4.91 per cent in the year-ago quarter.

Write-back in loans

The Bank received a huge write-back from non-performing asset (NPA) provisions to ₹2,759 crore (₹693 crore). It also received a write-back of ₹119 crore from other provisions (₹5 crore provision).

However, provisions for depreciation on investments and standard assets soared to ₹1,361 crore (₹43 crore) and ₹675 crore (against a write-back of ₹306 crore in the year-ago period), respectively.

Provisions for bad debts written-off stood at ₹1,086 crore (₹1049 crore).

Tax expenses jumped to ₹911 crore from ₹433 crore in the year-ago period.

Total deposits were up 12 per cent y-o-y to ₹3,10,294 crore as at March-end 2025. The proportion of low-cost current account, savings account (CASA) declined to 46.56 per cent of total deposits (50.43 per cent).

Net advances rose 16 per cent y-o-y to ₹2,18,399 crore as at March-end 2025. Within this, corporate advances rose 17 per cent; structured retail advances (housing loans, loans against property, auto loan, education and personal loans) and non-structured retail (gold loans, loans for Agri, MSME, Bulk business/Centralised business, other retail) were up 13 per cent each.

Gross non-performing assets (GNPAs) position improved to 2.98 per cent of gross advances as at March-end 2025 against 4.53 per cent as at March-end 2024. Net NPAs position too improved to 0.15 per cent of net advances from 0.34 per cent.

IDBI Bank’s shares closed at ₹82.63 apiece on BSE, up 2.17 per cent over the previous close.

Published on April 28, 2025

Post Comment