Carbonated juices to attract 12% GST, not 28%: High court

MUMBAI: Summer is here, and so is some refreshing news for consumers! In a significant ruling, the Gauhati high court has held that fruit pulp and juice-based carbonated drinks are not just “water or carbonated water alone.”

That means they attract a lower Goods and Services Tax (GST)— falling under the lower 12% GST slab instead of the steep 28% demanded by tax authorities. The HC order has effectively fizzed out the GST demand (plus penalty and interest) imposed on X’SS Beverage — a manufacturer and seller of a range of carbonated juice drinks.

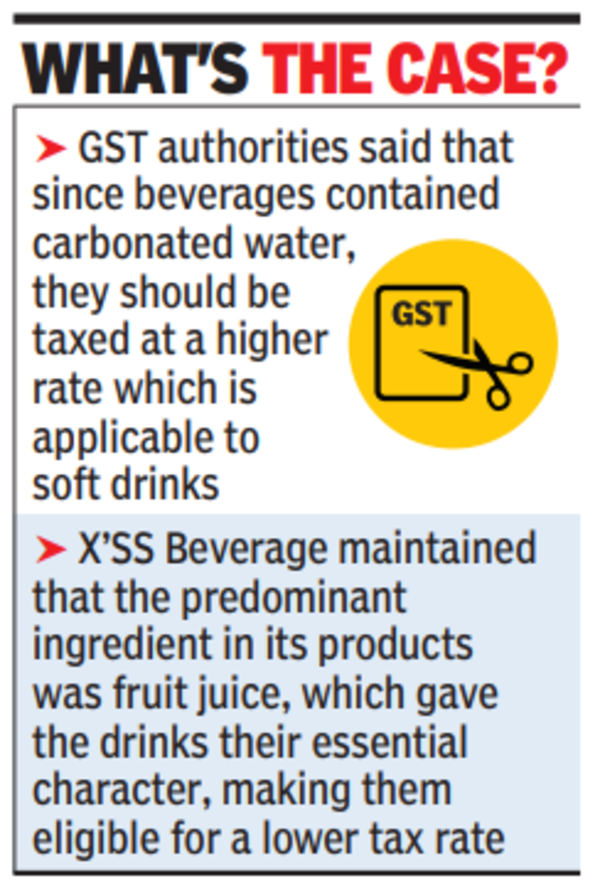

While the GST authorities contended that since the beverages contained carbonated water, they should be taxed at the higher rate which is applicable to soft drinks. In contrast, X’SS Beverage maintained that the predominant ingredient in its products was fruit juice, which gave the drinks their essential character, making them eligible for a lower tax rate.

The Gauhati high court relied on the Rules for Interpretation of the Customs Tariff Act, 1975, emphasising that in cases where products do not fit precisely into a single category, they should be classified under the heading most appropriate to their essential nature. The court also referred to scientific principles and judicial precedents such as in the case of Parle Agro’s ‘Appy Fizz.’

This being a high court judgement will set legal precedence. “There have been few adverse rulings on the classification of carbonated fruit drinks…In this case, the HC has rightly looked at all key aspects such as the ingredients, their proportion and role in manufacture, common parlance of the product, how the products are marketed, their label etc. to decide the classification and consequently a lower GST rate,” said Harpreet Singh, Partner, Indirect Tax, Deloitte-India.

Post Comment