ICICI Prudential Life Q4 jumps two-fold at ₹386 crore on net premium income growth

Solvency ratio improved to 212.2 per cent compared to 191.8 per cent in the year-ago period.

| Photo Credit:

REUTERS

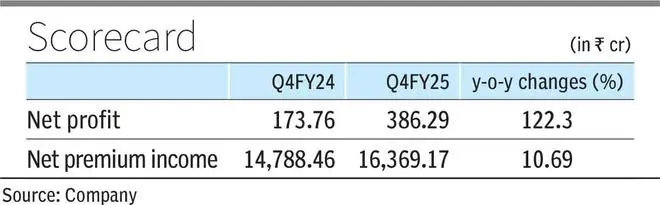

Private sector insurer ICICI Prudential Life Insurance on Tuesday reported a two-fold year-on-year (y-o-y) jump in its standalone net profit to ₹386.29 crore in Q4 of FY25, backed by a strong growth in its net premium income during the period.

The company had registered a net profit of ₹173.76 crore in the year-ago period.

The company’s net premium income grew 10.69 per cent y-o-y to ₹16,369.17 crore in Q4FY25 compared to ₹14,788.46 crore in Q4FY24, according to a stock exchange filing. Although the first-year premium fell 8.05 per cent y-o-y at ₹2,709.15 crore, renewal premium rose 9.27 per cent y-o-y to ₹9,209.44 crore for the period under review. Single premium grew 30.13 per cent on year, to ₹4,913.04 crore.

Management cost dips

During Q4FY25, the insurer’s expenses of management (EoM) stood at 14.7 per cent as against 16.9 per cent in Q4FY24. Solvency ratio improved to 212.2 per cent compared to 191.8 per cent in the year-ago period.

The 13th month persistency ratio fell to 84.3 per cent in the fourth quarter last fiscal from 87.4 per cent in the same period in the previous fiscal. The 49th month persistency ratio rose to 69.1 per cent from 67.5 per cent in the year-ago period, according to the stock exchange filing. The company’s annualised premium equivalent (APE) for the quarter under review fell 3.1 per cent y-o-y to around ₹3,502 crore.

Net profit for FY25 grew 39.6 per cent year-on-year to ₹1,189 crore from ₹852 crore in FY24. Value of New Business (VNB) for the last fiscal stood at ₹2,370 crore, up by 6.4 per cent on-year.

With a 15 per cent growth in APE at ₹10,407 crore in FY25, VNB margin stood at 22.8 per cent against 24.6 per cent in FY24. The company attributed the fall in VNB margin primarily to a shift in new business profile and assumption changes.

Commenting on the results, Anup Bagchi, MD & CEO, ICICI Prudential Life Insurance, said, “We are pleased to announce that we have crossed 10,000 crore APE for the first time, marking a significant milestone in our growth journey. Notably, we have also provided insurance coverage to over nine crore lives as on March 31, 2025. Our Retail Weighted Received Premium (RWRP) growth of 15.2 per cent in FY25, demonstrates our ability to deliver superior performance in a competitive landscape.”

Published on April 15, 2025

Post Comment