MSME optimism steady amid credit concerns, global trade uncertainty: SIDBI Survey

File picture: The Composite MSME Business Confidence Index (M-BCI) stood at 60.82 for Q4 FY2025, indicating a robust business environment.

| Photo Credit:

SRIRAM MA

The second round of SIDBI’s MSME Outlook Survey reveals continued optimism among Micro, Small, and Medium Enterprises (MSMEs) in the fourth quarter of FY2025, driven by a conducive business environment and positive sales growth.

However, as operations expand and capital expenditure increases, a significant number of respondents feel that the current credit availability falls short of their requirements.

While MSMEs remain broadly upbeat, optimism about the future has moderated slightly across sectors — likely influenced by concerns over recent shifts in US tariff policies and their potential impact on global trade and the competitiveness of Indian MSMEs.

Source: SIDBI

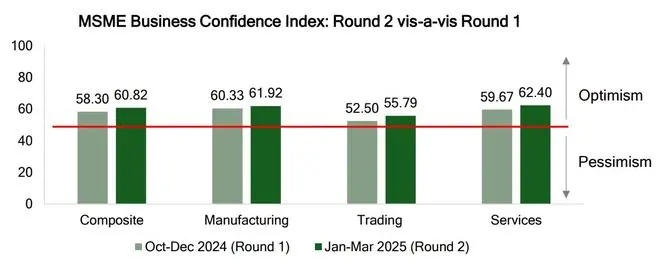

The Composite MSME Business Confidence Index (M-BCI) stood at 60.82 for Q4 FY2025, indicating a robust business environment. This marks an improvement from the 58.30 recorded in the previous quarter. Confidence remained strong in both manufacturing (61.92) and services (62.40), while the trading sector trailed slightly at 55.79. Nevertheless, all three sectors reported improved sentiment compared to the previous round.

In the manufacturing segment, optimism persisted, fuelled by strong sales expectations and a supportive operating climate. Despite rising input costs, profitability is expected to remain stable or improve, aided by increased production volumes and higher selling prices. However, access to credit continues to be a major concern, with many manufacturers citing insufficient funds and high financing costs.

The services sector emerged as the most confident of the three, reflecting buoyant domestic demand. Although rising salary and wage costs are anticipated, the sector expects to maintain healthy margins through increased billing rates.

The trading sector also showed positive sentiment, though to a lesser degree than manufacturing and services. Key challenges include limited access to credit and a shortage of skilled labour. To mitigate these, respondents aim to leverage digital technologies and broaden their market reach.

While 80 per cent of respondents reported access to finance, concerns about adequacy remain widespread. Roughly 40 per cent of MSMEs in both the manufacturing and services sectors indicated that existing credit availability does not meet their operational needs. Additionally, the cost of finance is an ongoing challenge, with around 40 per cent of MSMEs across sectors facing higher borrowing costs.

Published on April 8, 2025

Post Comment