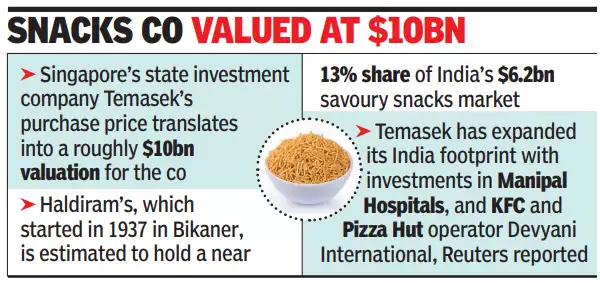

Singapore’s Temasek to pick 10% in Haldiram’s for Rs 8,500 crore

NEW DELHI: Singapore’s sovereign private equity giant Temasek is acquiring 9-10% stake in Haldiram Snacks Foods for over Rs 8,500 crore, valuing the company at around $10 billion. Haldiram Snacks Foods is the parent entity of Haldiram’s, widely recognised as the country’s largest snacks brand.

The acquisition marks one of the largest recent deals in India’s fast-moving consumer goods sector, potentially signalling more foreign investment ahead. The agreement, which was signed March 11, comes after months of negotiations, with Temasek emerging as the highest bidder for the minority stake. The investment underscores Temasek’s strategic focus on strengthening its presence in India’s rapidly expanding consumer sector, sources said.

Snacks co valued at $10 billion

While Temasek clinched the deal for minority stake, discussions with other PE biggies Blackstone and Alpha Wave Global, are reportedly underway for an additional 5% stake that the promoter family is considering to sell, sources added.

With a reported $37 billion exposure to India as of March 2024 and plans to invest an additional $10 billion over the next three years, Temasek is diversifying beyond its high-profile stakes in Manipal Health (where it owns 51% after a $2 billion investment) and Rebel Foods (where it led a $210 million round in 2024, valuing it at $1.4 billion).

Post Comment