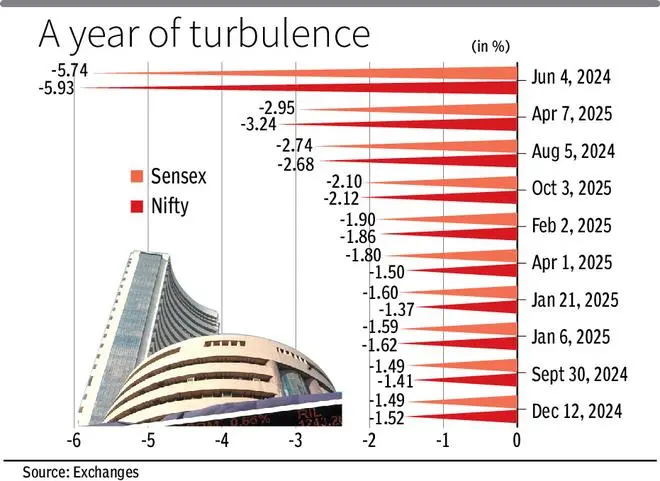

Tariff tensions nuke markets globally; Sensex, Nifty crash 3%

Markets crash as US-China trade tensions escalate, Sensex drops 2,226.79 points, Nifty 50 tumbles 742.85 points.

| Photo Credit:

iStockphoto

Around ₹13 lakh crore of investor wealth was wiped out on Monday and Indian equity benchmarks recorded their biggest fall in 10 months as higher-than-expected tariffs and no signs of an imminent deal brought home the fears of a full-blown trade war. The markets are expected to be under pressure on Tuesday as well, with US markets opening with deep cuts.

The selling was across asset classes. While the Sensex and Nifty50 fell 2.95-3.24 per cent, the rupee dropped 60 paise to log its steepest single-day fall in three months to end at a two-week low. Gold prices plunged below $3,000 per ounce as investors sold off the precious metal holdings along with other asset classes to cover losses elsewhere. Crude oil continued its decline, with WTI falling below $60 per barrel.

The Nifty50 ended 742.85 points down to close at 22,161.60 and the Sensex plummeted 2,227 points to 73,137.90. Value buying at lower levels by retail investors and domestic institutions in the last hour of trade pulled the Sensex more than 1700 points from its day’s low.

Foreign portfolio investors were net sellers to the tune of ₹9,040 crore, while domestic institutions were net buyers at ₹12,122.5 crore.

Explaining the sudden unravelling in the markets Akshay Chinchalkar, Head of Research at Axis Securities said countries had expected the reciprocal tariffs announcement to be measured and restrained. “But what has really spooked everybody is that they’ve been very brazen and President Trump has obviously seen his decisions have roiled global markets and yet he made the comment that he won’t go back on his policies.”

The market-wide sell-off saw 3,515 stocks declining against just 570 advances on the BSE, while 775 stocks hit 52-week lows compared to only 59 reaching 52-week highs.

Only two stocks managed to resist the downward pressure in the Nifty – Hindustan Unilever and and Zomato.

Sectoral indices painted a sea of red with Nifty Metal (-6.75 per cent), Realty, Auto, Financials, and IT all registering sharp losses between 3-5 per cent. Broader markets fared worse, with the Nifty Midcap 100 falling 4.76 per cent to 48,235.80. Among major losers, Trent led the decline with a 14.70 per cent drop, followed by JSW Steel (-7.53 per cent), Tata Steel (-7.26 per cent), Hindalco (-5.92 per cent), and Tata Motors (-5.34 per cent).

IT and metal stocks fell due to fears of a recession in the US, that could affect discretionary spend and demand.

“What is leading to this panic correction across the board is that if everything what Donald Trump said is implemented, then there is very high possibility of a global slowdown or recession. If global recession comes demand collapses and then anything which is priced based on demand, that will correct. So, commodities are correcting, even food is going down,” said Siddarth Bhamre, Head of Institutional Research at Asit C Mehta

“If everything is going to go down, then earnings will also go down, including stock markets,” he added.

Earlier in the day Asian markets plunged across the board. Japan’s Nikkei 225 tumbled 7.83 per cent, while the broader Topix shed 7.79 per cent. Hong Kong’s Hang Seng posted a steep 13.22 per cent fall, its worst in recent memory, and China’s Shanghai Composite declined 7.34 per cent. Heavy losses were also seen in Taiwan (-9.70 per cent), Singapore (-7.46 per cent), and South Korea (-5.57 per cent). Vietnam and Thailand saw more modest declines, while Bangladesh’s DSE 30 bucked the trend, gaining 1.60 per cent.

European stocks were trading sharply lower in the range 3.8-4.25 per cent in afternoon deals, echoing the global rout.

US markets opened deep in the red, with the Dow Jones shedding over 1,100 points while the S&P 500 and Nasdaq dropped 3.43 per cent and 3.68 per cent, respectively at 7 pm IST.

Technical analysts suggest the market may see continued volatility. “Technically, Nifty found support around the multiple support zones near 21,700. In the short term, the trend remains weak,” said Rupak De, Senior Technical Analyst at LKP Securities.

Market participants will now closely monitor the RBI monetary policy outcome expected later this week and the upcoming Q4FY25 earnings season, which could provide fresh direction amid the global uncertainties.

More Like This

Published on April 7, 2025

Post Comment