TCS Q1 results: Profit grew 6% y-o-y to ₹12,760 crore

Tata Consultancy Services CEO K Krithivasan during the Q 1 results 2025-26, in Mumbai, on Thursday

| Photo Credit:

SHASHANK PARADE

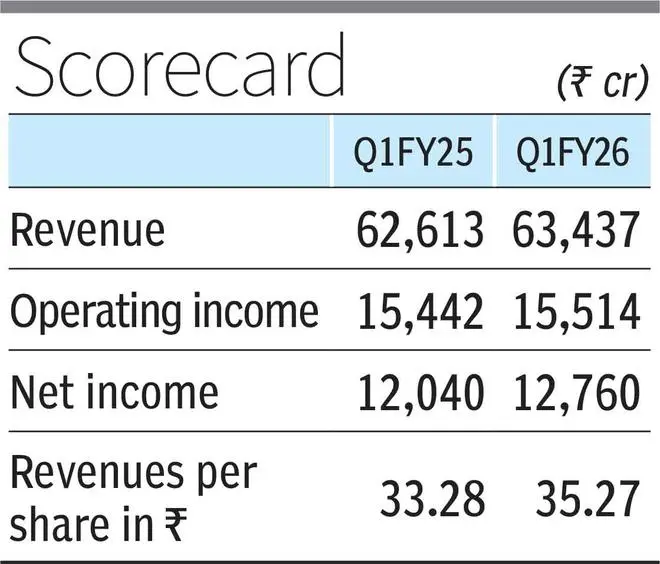

Tata Consultancy Services reported a 6 per cent rise in net profit in the first quarter of FY26 but lower-than-expected revenue as subdued discretionary spending and global geo-political uncertainties led to demand contraction. In a post earnings call the management said it was too early to say when growth would resume.

“The trend in delays in decision-making and project starts with respect to discretionary spends has continued and intensified in this quarter,” said K Krithivasan, Chief Executive Officer.

TCS’ Q1 revenue declined 3.1 per cent in constant currency terms. In rupee terms, it was at ₹63,437 crore, up 1.3 per cent on the year. Net profit, at ₹12,760 crore, got the benefit of increased ‘other income’ and delayed wage hikes.

Revenue in four of its six business verticals saw a decline, with life sciences and healthcare showing the most fall.

The approval of the US spending bill is expected to provide clarity by the end of this month or August, Krithivasan added.

However it was not all gloom. Its new services business grew well, while the quarter also saw robust deal activity. Its total contract value in the quarter rose to $9.4 billion from $8.3 billion in the year-ago period.

“We saw robust deal closures during this quarter. We remain closely connected to our customers to help them navigate the challenges impacting their business, through cost optimisation, vendor consolidation and AI-led business transformation” the CEO said.

“From an outlook perspective, we’re still optimistic that international revenue in FY26 will be better than our FY25 revenue. Overall, it would be too early to call out when growth will resume since it depends on clarity in macroeconomic scenario,” he said.

When asked whether high single digital growth is possible, the CEO said the company is optimistic given order book and customer conversations, adding that many customers need to go through customer transformation.

According to a brokerage analyst, the TCS stock will likely see a negative reaction post-result day. The topline was unable to cover up the impact of the BSNL ramp-down. The company had received an Advance Purchase Order (APO) from the telecom provider earlier this year but is yet to issue the Final Process Order.

“The deal TCV looks fine, but need to see the call rate and what their outlook is for the year and how the BSNL impact will carry forward,” said the expert, adding that from a constant currency point of view, the numbers have seen a much sharper fall than expected.

Agentic AI

Aarthi Subramanian, Executive Director – President and Chief Operating Officer, said “Launching TCS SovereignSecureTM Cloud, TCS DigiBOLTTM, and TCS Cyber Defense Suite, to accelerate India’s AI led transformation was a particular highlight of this quarter”.

Krithivasan also announced the appointment of Aarti Subramanian as the President and Chief Operating Officer and Mangesh Sathe as the Chief Strategy Officer.

Subramanian said agentic AI has become part of all client conversations, with TCS talking to customers on two fronts – industry value chain solutions for BFSI and manufacturing where the initial anchor customers are coming in. The other area is business process services (BPS) where AI relooks at traditional automation.

Samir Seksaria, Chief Financial Officer, said, “We continued our investments in long term sustainable growth this quarter. We stayed agile and adapted to the dynamic environment, delivering steady margins. Our industry leading profitability alongside robust cash conversion, positions us well to make strategic investments for the future”.

In terms of geography, North America’s growth declined by 2.7 per cent year-on-year while India’s growth plummetted by 21.7 per cent. UK fell by 1.3 per cent y-o-y.

When asked about the performance of regional markets, Krithivasan said, “We’re focused on all regional markets. India is one of the important markets for us, similarly focused on middle east and africa. We’ve been getting strong winds from ASEAN countries. We’ve always been strong in Singapore. Last year we focused in Malaysia and now we’re looking at Philippines and Indonesia as well.”

In terms of geographies, experts attributed the drag to India with a wait-and-watch call on regional markets. India is 5.8 per cent of revenue now, a significant decline from 9.8 per cent of revenue a couple of quarters ago. Regional is 13 per cent of revenue in Q1.

Total contract value (TCV) fell almost 23 per cent to $9.4 billion. Operating margin stood at 24.5 per cent. But with a sequential improvement of 30 bps.

The company’s workforce strength increased by 0.8 per cent to a headcount of 613,069 employees with an LTM IT attrition rate of 13.8 per cent. In Q1, headcount increased by 5,090 employees. Last quarter, TCS said it was deferring salary hikes for employees starting April due to macroeconomic uncertainty.

Milind Lakkad, Chief HR Officer,said“In this quarter, our associates invested 15 million hours in building expertise in emerging technologies, enabling them to lead the transformation journey for our customers. It is gratifying to note that TCS now has 114,000 people with higher order AI skills”.

This also marks the final quarter for Lakkad, whose position will be taken over by Sudeep Kunnumal.

Published on July 10, 2025

Post Comment