Trump’s tariff gambit: How it’s reshaping India, China, and the global economy

US President Donald Trump is escalating his global trade war, targeting not just China but also allies like India. As part of his “America First” economic strategy, Trump announced that India will face reciprocal tariffs starting April 2, claiming that the country imposes some of the highest duties on US goods.

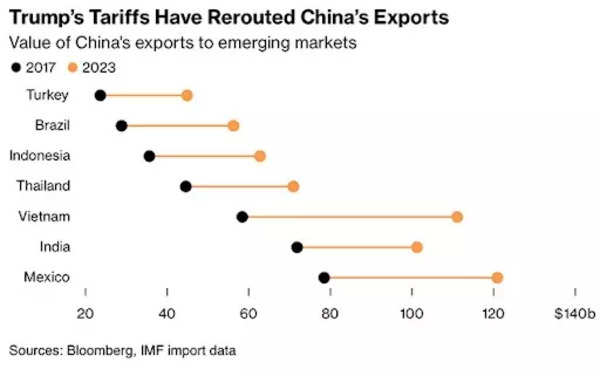

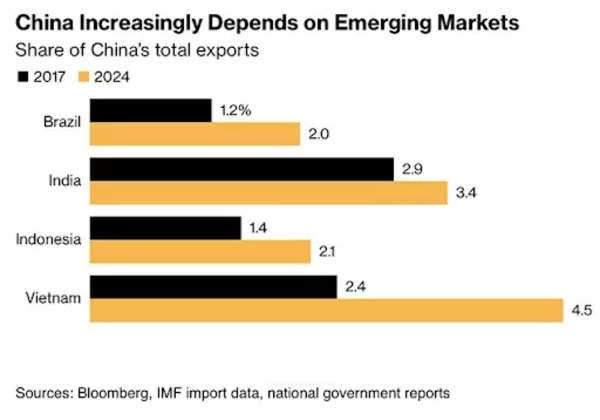

Meanwhile, his crackdown on Beijing is triggering a new “China Shock,” as excess Chinese exports flood global markets, disrupting industries and destroying jobs worldwide, a Bloomberg report said. The world’s largest exporter, facing increased trade barriers in the US, is flooding other markets with cheap goods—undercutting local manufacturers and eliminating jobs from Mexico to Indonesia to India.

Driving the news

In an interview with Breitbart News, Trump said that while India is a “wonderful nation,” it has tariffs that are unfair to the US. “I have a very good relationship with India, but the only problem I have is they’re one of the highest tariffing nations in the world,” he said. “I believe they’re going to probably be lowering those tariffs substantially, but on April 2, we will be charging them the same tariffs they charge us.”

.

On China, Trump is taking an even more aggressive stance, arguing that Beijing’s economic expansion is hurting American workers and destabilizing industries worldwide. His latest tariffs are designed to curb China’s influence, but they are also causing widespread disruptions in other economies that rely on trade with China.

The economic fallout is already visible in Southeast Asia, where Chinese exports—redirected from the US due to tariffs—are undercutting local businesses.

Why it matters

Trump’s tariff war is not just a US-China showdown—it’s reshaping global trade patterns, forcing countries like India to make tough choices and wreaking havoc on emerging markets:

India’s dilemma: While Prime Minister Narendra Modi has cultivated strong ties with Trump, India is scrambling to reduce trade tensions. In recent weeks, it has lowered duties on bourbon, high-end motorcycles, and certain agricultural goods. More tariff reductions could follow as Indian officials work to avoid a full-scale trade war with the US.

China’s overflow problem: With US import barriers rising, Chinese manufacturers are aggressively seeking new markets. The result? An oversupply of Chinese goods in countries like Indonesia, Mexico, and Brazil, putting pressure on local producers.

A global economic risk: Trump’s tariffs have already rattled markets. As April 2 approaches, uncertainty is growing, with investors worried about inflation and supply chain disruptions. Federal Reserve Chair Jerome Powell recently noted, “Uncertainty is remarkably high.”

New ‘China Shock’: India, others in crosshairs

- Trump’s trade war is also fueling a second wave of the “China Shock,” a term used by economists to describe the massive economic disruption caused by China’s rise as a manufacturing powerhouse in the early 2000s. Now, as Trump closes the door on Chinese imports, those products are flooding global markets—leading to economic distress in countries from Indonesia to Mexico.

- India in the crosshairs: India is feeling the heat. Authorities in New Delhi have launched anti-dumping probes into a range of Chinese products, including solar cells and mobile phone components, to shield domestic industries. Meanwhile, local textile producers are struggling to compete against a flood of inexpensive Chinese garments.

- The situation in India mirrors what is happening in Mexico and Southeast Asia. As per the Bloomberg report, in Mexico, President Claudia Sheinbaum has linked rising violence in industrial regions to mass layoffs caused by the influx of Chinese goods. “So much of the entry of Chinese products into Mexico caused this industry to fall in our country,” Sheinbaum said.

- Indonesia’s textile and apparel industry has shed around 250,000 jobs over the past two years, with an additional 500,000 positions projected to be at risk by 2025. This trend would amount to losing roughly one in four industry jobs within just a few years. The pace of these job losses surpasses the so-called “China Shock,” during which the US lost as many as 2.4 million jobs between 1999 and 2011.

- Thailand has imposed a value-added tax on low-cost Chinese imports. Sanan Angubolkul, the head of Thailand’s Chamber of Commerce, warned that the situation is “very critical, and there’s no time to waste” as the nation deals with a surge of electrical appliances, clothing and other Chinese goods, the Bloomberg report said .

- Vietnam has ordered Chinese e-commerce giants to suspend operations.

- In Indonesia, garment manufacturers are struggling to compete with cheap Chinese textiles. The Indonesia Fiber and Filament Yarn Producer Association estimates that one in four jobs in the sector could disappear this year.

What they’re saying

- Trump’s latest trade moves have sparked strong reactions from business leaders, economists, and government officials:

- Donald Trump, on trade negotiations: “We have a powerful group of partners in trade. Again, we can’t let those partners treat us badly… The ones that wouldn’t be as friendly to us in some cases treat us better than the ones that are supposed to be friendly.”

- Howard Lutnick, US commerce Ssecretary: “These policies are the most important thing America has ever had… It is worth it.”

- Henrietta Treyz, economic analyst: “Markets remain skittish because this isn’t just about China anymore. Trump’s April 2 tariffs will hit everyone.”

- Brian Coulton, Fitch chief economist: “Tariff hikes will result in higher US consumer prices, reduce real wages, and increase companies’ costs.”

- “This is China Shock 2.0 or China Shock 3.0. China has this immense manufacturing capacity, and the goods have to go somewhere” Gordon Hanson, a professor of urban policy at the Harvard Kennedy School, told Bloomberg.

Zoom In: India’s trade battle

- India, which is both a competitor and a partner to China, faces unique challenges in this trade war:

- The country’s automotive, chemical, and electronics sectors have benefited from Trump’s tariffs on China, as US firms seek alternative suppliers.

- However, India also imports heavily from China, meaning that any trade barriers on Chinese goods could raise costs for Indian manufacturers.

- Trump’s demand for reciprocal tariffs puts India in a difficult position. If India refuses, it risks losing access to the lucrative US market. But if it complies, domestic industries—especially agriculture and small businesses—could suffer.

What’s next

- As the April 2 tariff deadline approaches, several key developments could shape the outcome:

- India’s concessions: The Modi government is in talks to lower more tariffs, but it remains unclear if these moves will be enough to satisfy Trump.

- China’s retaliation: If China feels further cornered, it could step up its trade offensive, worsening the economic fallout for other countries.

- Global recession fears: Economists warn that escalating trade tensions could push the world closer to a recession, with inflation rising and investment slowing.

The bottom line

Trump’s tariff war is reshaping the global economic order. India is trying to navigate a delicate balance, China is flooding markets with cheap goods, and developing nations are facing a fresh wave of job losses. With April 2 looming, the world is watching to see whether Trump’s hardball tactics will succeed—or whether they will trigger an even bigger economic crisis.

(With inputs from agencies)

Post Comment