Wipro Q4 net profit up 26% to ₹3,569 cr; company revises guidance downwards

Wipro Records Declines in Europe, Americas 2 Faces Slower Growth

| Photo Credit:

Dado Ruvic

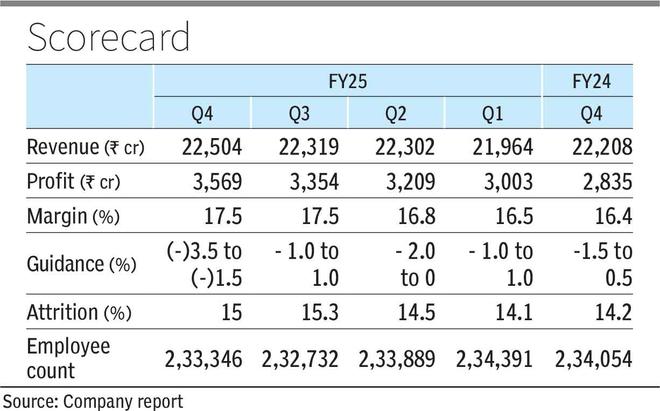

IT major Wipro closed the fourth quarter of FY25 at a net profit of ₹3,569 crore, growing 6.4 per cent sequentially and 25.9 per cent on a year-on-year (y-o-y) basis. However, citing macroeconomic uncertainties, the company guided a revenue degrowth of 3.5 to 1.5 per cent in constant currency terms (cc) for its IT services segment in Q1FY26.

Revenue from operations during the March-ended quarter stood at ₹22,504 crore, reflecting a marginal increase of 0.8 per cent q-o-q from Q3’s ₹22,319 crore and 1.3 per cent y-o-y. However, the IT services segment revenue was at $2,596.5 million, marking a decline of 1.2 per cent q-o-q and 2.3 per cent y-o-y.

Regional Performance

During the quarter, Americas 1 recorded a sequential growth of 0.2 per cent and a 6 per cent y-o-y growth in Constant Currency (cc) terms. Americas 2 — which comprises the BFSI, Energy, Manufacturing and Resources, Capital Markets and Insurance, and Hi-tech sectors in the US — declined by 1.0 per cent q-o-q and 1.8 per cent y-o-y, both in cc.

Europe also saw a decline, with a 2.5 per cent sequential drop in cc terms and a 6.9 per cent cc decrease y-o-y, with the region expected to face further challenges due to the imposition of tariffs. In contrast, APMEA grew 1.0 per cent q-o-q cc but contracted 4.9 per cent cc on a y-o-y basis.

Sector-wise, the BFSI segment declined 0.5 per cent sequentially but grew 0.8 per cent y-o-y in cc, though growth was hindered by “client-specific issues” in the European market. Other sectors, such as Healthcare, Consumer, and Technology & Communication also saw declines. While the Energy, Manufacturing, and Resources vertical posted sequential growth, it registered a y-o-y decline.

Wipro’s consulting arm, Capco grew 6.5 per cent sequentially and 11.5 per cent on a y-o-y basis.

CEO & MD Srini Pallia expressed concern regarding the recovery of discretionary spending. “Given the uncertainty in the environment, we expect clients to take a more measured approach going forward, especially on large transformation programs and discretionary spending, attributing this to the revised revenue guidance.

However, Wipro enjoyed a 48.5 per cent y-o-y jump in large deal TCV on the back of 17 large deals with a total value of $1.8 billion. The total bookings stood at $4 billion, a 10.5 per cent y-o-y growth from last quarter’s $3.5 billion.

Aparna C Iyer, the Chief Financial Officer, noted, “The number of clients greater than $50 million has remained the same. The reduced number of clients in the lower bucket is a reflection of the weaker discretionary spending. Our top ten and top five clients have continued to grow sequentially even in this quarter.”

Attrition during the quarter stood at 15 per cent. The company’s headcount was 233,346 in Q4FY25, compared to 234,054 in Q4FY24. At the beginning of the fiscal, Wipro announced plans to hire around 10,000-12,000 freshers for the full year.

Biswajit Maity, Sr Principal Analyst at Gartner commented, “Wipro saw muted growth mainly due to weak discretionary spending and global economic challenges. However, its strong deal pipeline suggests a positive outlook for future growth.”

He added, “Wipro must address its attrition rate, although it has slightly improved compared to the previous quarter. As workload pressures increase, maintaining workforce stability is critical to preserving service quality and meeting delivery expectations—any challenges in this area could pose risks to its future growth trajectory.”

Wipro’s shares closed at ₹247.50 up by 1.39 per cent on the BSE. Results were announced post-market closure in India.

With inputs from bl intern Rohan G Das

Published on April 16, 2025

Post Comment