Auto dealers across India brace for uncertain month shaped by both domestic and global factors: FADA

(Pic for representational purposes only) The India Meteorological Department’s warning of intense heatwaves looms over consumer footfall and infrastructure activity, while renewed tariff tensions on the international stage add market volatility and can rattle buyer sentiment.

As the new financial year begins, auto dealers across India are bracing for an uncertain month shaped by both domestic and global factors, Federation of Automobile Dealers Associations (FADA) said on Monday. The federation added that the India Meteorological Department’s (IMD) warning of intense heatwaves looms over consumer footfall and infrastructure activity, while renewed tariff tensions on the international stage add market volatility and rattle buyer sentiment.

“Adding to the uncertainty is the looming spectre of a global tariff war, which could spark stock market turbulence and erode returns on mutual fund SIPs. If investors see their disposable incomes shrink in tandem with market volatility, discretionary spending—like auto purchases—may well suffer. Within the passenger vehicle (PV) segment, new launches and strategic marketing can offer a lift, but widespread concerns remain about subdued consumer sentiment,” C S Vigneshwar, President, FADA, said.

Having said that nearly half of surveyed dealers still expect April sales to be flat and over a third foresee some growth—driven partly by regional festivals and the marriage season. Yet, the picture is far from rosy: nearly 60 per cent of dealers across all segments report weak booking pipelines, signalling a fragile foundation on which any optimism must rest, he said while sharing the monthly sales data.

He said two-wheeler dealers also anticipate a lift from festive buy-ins and marriage-season demand, but they remain wary of rising on-board diagnostics (OBD)-2B costs, weak rural liquidity, and mounting competition from electric vehicles, he said.

In the commercial vehicle (CV) segment, Vigneshwar said dealers hope to maintain the tempo of a strong March, but heatwave disruptions and global trade anxieties could quickly stall the momentum.

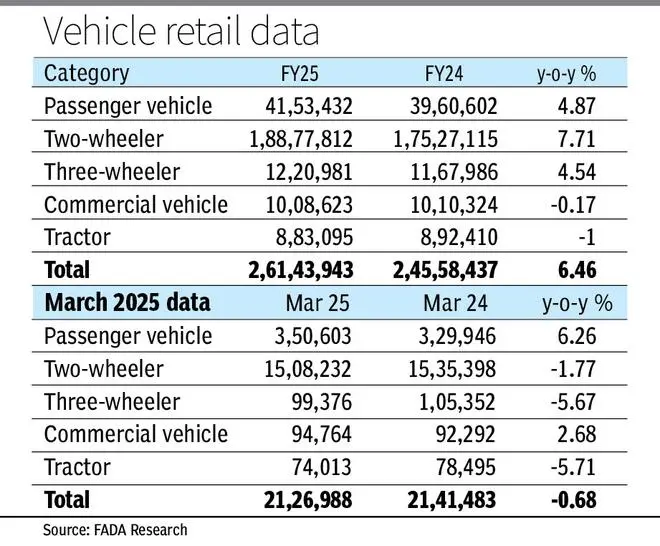

In terms of monthly sales, FADA’s latest report, the PV retail sales grew by 6.26 per cent year-on-year (Y-o-Y) to 3,50,603 units in March as compared with 3,29,946 units in the corresponding month last year.

However, two-wheeler sales declined by around two per cent Y-o-Y to 15,08,232 units during the month as compared with 15,35,398 units in March 2024.

Three-wheeler sales also declined by around six per cent Y-o-Y to 99,376 units in March as compared with 1,05,352 units in the same month last year.

CV sales rise 3%

CV retail sales grew by around 3 per cent Y-o-Y to 94,764 units during the month as compared with 92,292 units in March 2024.

The overall retail sales across categories marginally declined to 21,26,988 units in March as against 21,41,483 units in the corresponding month last year.

On annual basis, the PV sales grew by around five per cent Y-o-Y to 41,53,432 units in financial year 2024-25 (FY25) as compared with 39,60,602 units in FY24, the FADA report said.

Two-wheeler sales grew by around 8 per cent Y-o-Y to 1,88,77,812 units during the year against 1,75,27,115 units in the previous financial year.

FADA said 2W in rural markets grew by 8.39 per cent vs. 6.77 per cent in urban areas in FY25. PV also performed better in rural belts with 7.93 per cent growth, compared to 3.07 per cent in urban markets during the year.

Three-wheeler sales grew by 4.54 per cent Y-o-Y to 12,20,981 units in FY25 as compared with 11,67,986 units in the April-March period previous year.

However, CV sales declined marginally to 10,08,623 units during the year as compared with 10,10,324 units in FY24.

In total, retail sales of vehicles across categories grew by 6.46 per cent in FY25 to 2,61,43,943 units as compared with 2,45,58,437 units in FY24.

More Like This

Published on April 7, 2025

Post Comment