I-T Bill 2025 referred to Parliament’s select committee

NEW DELHI: A select committee of the Parliament will vet the Income Tax bill, after Union finance minister Nirmala Sitharaman introduced it in Lok Sabha on Thursday, and urged the Speaker that it be referred for the parliamentary panel’s scrutiny. The select committee will submit its report on the first day of the monsoon session.

The bill was introduced after objections from MPs N K Premachandran, Manish Tewari and Saugata Roy were overruled. The three members had questioned the bill’s introduction on various grounds.

Sitharaman said Premachandran’s objection that the proposed bill was increasing the total sections was incorrect. She said when the bill was enacted in 1961, it had 298 sections which, with time, went up to 819 sections, while the new bill was bringing them down to 536 sections. She said that the bill is half the size of the current law in terms of the word count – 2.6 lakh instead of 5.1 lakh.

She said Premachandran should compare the proposed bill with where it stands at present, instead of where it was in 1961. She also dismissed Premachandran’s claim that “objects and reasons” of the new bill were different from those of the original bill.

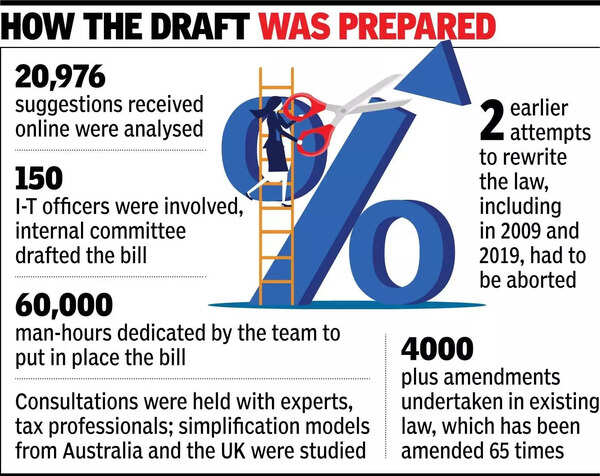

The tax department said that it followed a detailed exercise with a team of 150 officers to draft the new bill over the last six months. The focus has been on making the law shorter and simpler by doing away with obsolete provisions, 900 provisos and close to 1,200 explanations and introducing tables and formulae.

The tax department said the bill lays down the administrative framework, assigns roles and responsibilities for assessing officers, taxpayers, tax deductors and professionals. In addition, it sets out the framework for income determination, timelines, appellate procedures, enforcement, assessments, and penalties.

“With the new Income Tax Bill, 2025 being tabled in Parliament, the process to repeal over-six-decades-old tax code is underway, which over the years had become complex, as tax laws were amended to keep pace with emerging business realities… Perhaps the expectations that the proposed bill would also herald a new era of dispute resolution mechanism may not have been addressed, however the door is not closed considering govt’s repeated acknowledgement of the need to address burgeoning tax disputes,” said Naveen Aggarwal, partner-tax at KPMG in India.

Post Comment