Maruti Suzuki Q3 Results: Net profit up 16% to ₹3,727 cr, highest ever vehicle sales

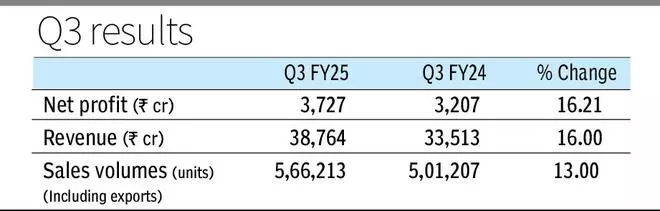

Driven by bumper sales during the festive season and rest of the months, Maruti Suzuki India (MSIL) on Wednesday reported 16.21 per cent year-on-year (y-o-y) growth in its consolidated net profit to ₹3,727 crore for the third quarter (Q3) ended December 31, as compared with ₹3,207 crore in the corresponding period last fiscal year (FY).

Meeting the streets’ expectations, consolidated revenue of the company also grew by around 16 per cent y-o-y to ₹38,764 crore for the quarter in review as against ₹33,513 crore in the October-December quarter last fiscal year.

During the quarter, MSIL sold a total of 5,66,213 vehicles in which the domestic market contributed 4,66,993 units and the exports accounted for 99,220 units, the highest-ever in any quarter, the company said.

The same period in the previous year saw total sales of 5,01,207 units comprising 4,29,422 units in domestic and 71,785 units in export markets.

For the nine-month period, the company’s consolidated net profit also rose by five per cent y-o-y to ₹10,589 crore as compared with ₹9,536 crore in the April-December period last fiscal year.

Similarly, consolidated revenue also grew by 8.32 per cent y-o-y to ₹1,11,993 crore in April-December FY25 as against ₹1,03,387 crore in the corresponding period last fiscal year.

MSIL also recorded its highest-ever nine monthly sales volume of 16,29,631 units during the period, five per cent up y-o-y as compared with 15,51,292 units in April-December 2023.

Meanwhile, the Board of the company has approved the Scheme of Amalgamation (scheme) between MSIL, Suzuki Motor Gujarat (a wholly owned subsidiary of the company) and their respective shareholders and creditors as per the applicable provisions of the Companies Act, 2013 and rules framed thereunder.

“There will be no change in the shareholding pattern of MSIL pursuant to the aforesaid scheme of amalgamation as no shares are being issued by MSIL in consideration for such amalgamation,” the company said in a filing to BSE.

Also, the Board of Directors of MSIL has approved the reappointment of Hisashi Takeuchi as Managing Director and Chief Executive Officer for a further period of three years with effect from April 1, 2025, till March 31, 2028.

The Board also recommended the re-appointment of Maheswar Sahu as an Independent Director for a further period of five years with effect from May 14, 2025, to May 13, 2030, for approval of the Members.

Shares of MSIL closed at ₹11,973.15 apiece on the BSE, down 1.24 per cent from the previous close.

Post Comment