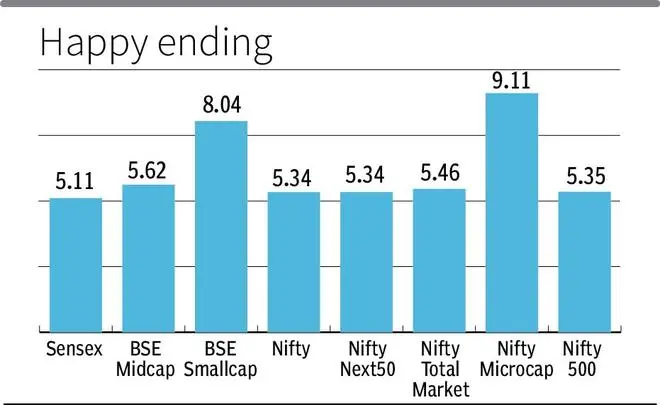

Sensex, Nifty gain over 5% in FY25

Market concluded the financial year 2024-25 on a cautious note, with benchmark indices experiencing marginal declines on Friday as investors remained wary of impending US reciprocal tariffs and the upcoming economic data releases. However, for FY25, the BSE Sensex and the Nifty gauge jumped over 5 per cent each. The Nifty Midcap climbed 8.40 per cent and the Nifty SmallCap surged over 6 per cent.

Looking back at the financial year, markets have shown remarkable resilience. “Benchmark indices ended FY25 on a positive note with a strong rebound in March after five consecutive monthly declines,” noted Satish Chandra Aluri from Lemonn Markets Desk.

The BSE Sensex hit its all-time high of 85,978.25 and the NSE Nifty hit a peak of 26,277.35 on September 27, last year.

However, Nifty 50 on Friday dropped 72.60 points (0.31 per cent) to settle at 23,519.35, while the Sensex fell 191.51 points (0.25 per cent) to close at 77,414.92. Despite the day’s softness, the market maintained positive momentum for the month, with Nifty gaining 6.3 per cent in March.

Sectorally, Pharma, Metal and Bank were the top performers in FY25, while NSE Energy, PSU Bank, Media and Realty were the worst performers.

According to NSDL data, FPI sold shares worth ₹1.27 lakh crore in FY25.

However, foreign portfolio investors (FPIs) played a crucial role in shaping market sentiment during the month. According to Shrikant Chouhan from Kotak Securities, FPIs continued to be net cash buyers, infusing ₹6,367 crore in March.

The FPI landscape across emerging markets revealed a nuanced picture. While countries such as Indonesia, Malaysia, Taiwan, Thailand and Vietnam experienced significant outflows, India stood out alongside Brazil, the Philippines and South Korea as destinations for positive foreign investment. These four markets witnessed inflows of $28 million, $756 million, $44 million and $266 million respectively.

Sector-specific performance revealed mixed trends on Friday, with FMCG and private banking stocks providing some support, while IT, media and auto sectors witnessed notable declines. Infosys and Wipro were among the top losers, with stock prices falling 2.1 per cent and 3.7 per cent respectively.

“Nifty’s rally is fading, driven by Trump’s tariff concerns. Volatility is expected to persist, with resistance at the 200-Day Moving Average of 24,082,” said Prashanth Tapse, Senior VP (Research) at Mehta Equities.

The financial year’s concluding session was characterised by cautious trading, with investors anticipating key economic triggers. The US Personal Consumption Expenditures (PCE) inflation data and the upcoming announcement of reciprocal tariffs by the US administration are expected to significantly influence market sentiment in the near term.

On the currency front, the rupee demonstrated resilience, gaining 32 paise to close at 85.46 against the US dollar – its highest level in three months. This appreciation was attributed to foreign institutional investor (FII) inflows, stable crude prices and a weaker dollar.

Broader market indices also reflected the cautious sentiment. The Nifty Midcap 100 and Smallcap 100 indices declined 0.32 per cent and 0.15 per cent respectively, indicating profit-booking at higher levels.

Top gainers for the day included Tata Consumer (+2.91 per cent), Kotak Bank (+2.13 per cent), Apollo Hospitals (+1.88 per cent), ONGC (+1.79 per cent), and ICICI Bank (+0.85 per cent). Conversely, IndusInd Bank (-3.64 per cent), Wipro (-3.56 per cent), Shriram Finance (-3.28 per cent), Cipla (-2.83 per cent), and Mahindra & Mahindra (-2.63 per cent) were the notable decliners.

The March rebound was driven by improving domestic optimism and the return of foreign flows. Valuations became more aligned with historic averages, and there are early signs of growth revival. The market saw rising expectations of potential rate cuts from the Reserve Bank of India (RBI) as inflation moved below the 4 per cent target in recent months.

Sector performance during March was notably diverse. While beaten-down sectors such as Nifty PSE, Nifty Energy and Nifty Commodities led the rebound rally, the IT sector was the sole segment to post losses. These IT sector losses were primarily driven by concerns over US growth, rising recession risks and the potential impact of aggressive trade policies.

Technical analysts suggest continued caution. “The near-term uptrend remains intact, and the downward correction has not damaged the underlying trend,” said Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities.

In the commodities space, gold continued to attract significant investor attention. Jateen Trivedi, VP Research Analyst at LKP Securities, noted that gold prices were trading higher in the spot market, driven by persistent tariff concerns. With the approach of April 2 reciprocal tariffs, and expectations of US President Donald Trump imposing tariffs across trade deals, gold maintained its upward trajectory.

The precious metal has been consistently hitting new all-time highs, supported by ongoing geopolitical and economic tensions. The price range for gold remained elevated between ₹87,500 and ₹89,750, reflecting the market’s uncertainty and investors’ flight to safe-haven assets.

As the market transitions into the new financial year, investors will closely monitor the RBI’s upcoming policy meeting, potential rate cuts and the evolving global trade landscape shaped by emerging geopolitical dynamics.

With 62 stocks hitting 52-week highs and 428 touching 52-week lows, the market’s complexity underscores the need for strategic, selective investment approaches in the coming months.

The markets are expected to experience elevated uncertainty and continued volatility in FY26, driven by the potential reshaping of global supply chains and capital flows in response to trade tensions and geopolitical shifts.

Post Comment