Shriram Life Q3 Results: Net profit drops 14% to ₹43 cr, but total premium surges 37%

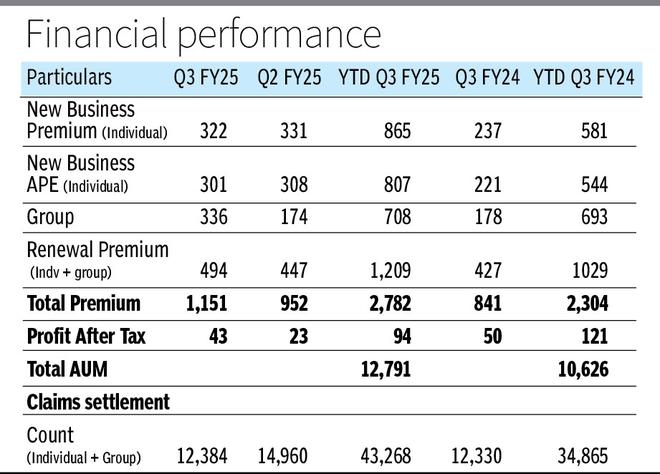

Shriram Life Insurance has reported a 14 per cent decline in its profit after tax at ₹43 crore for the quarter ended December 31, 2024, when compared with ₹50 crore in the year-ago quarter.

However, the company’s total premium surged 37 per cent to ₹1,151 crore in Q3FY25 against ₹841 crore in Q3FY24, driven by group premium which more than doubled year-on-year basis.

- Also read: CleanMax, Amazon sign PPA for 100 MW renewable energy project in Karnataka

Premium zoomed

The company’s premium from group business in the third quarter zoomed to ₹336 crore from ₹174 crore in the year-ago period. New individual business premium increased by 36 per cent to ₹322 crore in Q3FY25, up from ₹237 crore in Q3FY24. New Individual Business APE (Annual Premium Equivalent) rose by 36 per cent to ₹301 crore ifrom ₹221 crore in Q3FY24. Its renewal premium—which includes both individual policies as well as group policies—stood at ₹494 crore, up from ₹427 crore in the year-ago period.

“Our quarterly results show our commitment to reaching and securing more customers, which also reflects the need for affordable life insurance solutions among various segments, said Casparus JH Kromhout, MD and CEO, Shriram Life Insurance.

- Also read: TVS Srichakra enters US market, showcases Eurogrip tyres at AIM Expo 2025

Faster than private industry

For the period April-December 2024, individual new business APE grew by 49 per cent y-o-y, growing faster than the private industry at 19 per cent. The total premium for the April-December 2024 stood at ₹2,782 crore at a y-o-y growth of 21 per cent.

The company’s solvency ratio stood at 1.76 Its claim settlement ratio for FY24 was at 98 per cent, with non-investigated claims being settled within 12 hours from the time of full document submission, said the statement.

Post Comment