Sundram Fasteners sees modest profit growth in FY25

Arathi Krishna, Managing Director, Sundram Fasteners

Sundram Fasteners, a leading player in the auto parts industry, reported a decline in consolidated net profit for the March 2025 quarter and a marginal increase for the full FY25 period, while also declaring a second interim dividend of ₹4.20 per share.

With this declaration, the total dividend for FY25 stands at ₹7.20 per share (720 per cent).

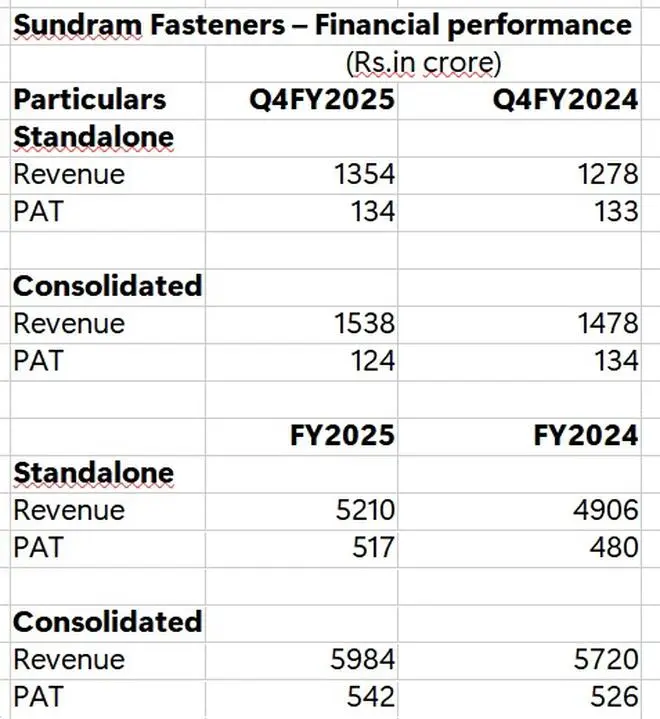

On a consolidated basis, the company’s net profit fell to ₹124 crore for the March 2025 quarter, down from ₹134 crore in the same period last year. Consolidated revenue, however, rose to ₹1,538 crore (₹1,478 crore), according to a statement.

On a standalone basis, the company recorded a marginal increase in net profit at ₹134 crore in Q4 FY25 (₹133 crore), with revenue rising to ₹1,354 crore (₹1,278 crore).

“We achieved our highest-ever quarterly PAT of ₹134.37 crore through continued financial discipline, maintaining a positive cash balance, and implementing best practices in quality management and automation. This growth is particularly encouraging, driven by substantial progress in our non-auto segment, which has strengthened our overall performance,” said Arathi Krishna, Managing Director, Sundram Fasteners. “Our growth is further supported by a healthy domestic and export order book. We remain focused on volume-led growth by capitalising on opportunities in the electric vehicle segment and maintaining our emphasis on innovation to surpass industry growth.”

Full year FY25

For the full year ended March 31, 2025, the company’s consolidated net profit rose to ₹542 crore (₹526 crore), while consolidated revenue increased to ₹5,984 crore (₹5,720 crore).

On a standalone basis, net profit for FY25 grew to ₹517 crore (₹480 crore), with revenue increasing to ₹5,210 crore (₹4,906 crore). Driven by strong customer demand, exports grew 12.39 per cent to ₹1,584 crore (₹1,409 crore), while domestic sales rose to ₹3,458 crore (₹3,339 crore).

Earnings per share for the year ended March 31, 2025, stood at ₹24.60 (₹22.83).

The company reported capital expenditure of ₹376.43 crore during the year, aimed at expanding capacity across existing business lines and supporting new projects. These investments are expected to significantly enhance the company’s ability to meet customer needs across segments including ICE vehicles, plug-in hytbrid electric vehicles and EVs, it said.

Published on April 30, 2025

Post Comment